Provide information to facilitate transparency and honesty in business.

The truth is, business owners would rather not have to accept credits cards at all. However, as it is painfully evident, not accepting cards can seriously affect revenue. Consequently, at the end of each month we get a statement from our processor summarizing the credit card transactions we processed and a corresponding figure (ouch!!) of how much it cost us to process these transactions. So the question is: Are we being treated unfairly? And if so, Is there a solution? The answer of course is, yes, and the solution is easier than you would think: Be better informed.

It is important to know that costs associated with accepting credit cards can be reduced, and sometimes significantly. So why do we keep paying higher rates than we need to?

To offer some explanations:

1. Merhchant statements are complex so we avoid studying them.

2. We accept the status quo as “the cost of doing business”.

3. We get too many solicitations offering a “better” rate.

4. And if we do switch, it is déjà vu and the cycle repeats.

Let’s put an end to that by performing a quick statement analysis and calculate the most important figure on your statement, the Effective Rate

In the next few sections, I will explain how to calculate your Effective Rate and provide some additonal information to assess weather that rate is reasonable and some other things to lookout for.

If you have questions at any time during your analysis, please feel free to contact me. And if you feel you would rather have me perform the anlysis for you, just send me an email or call me at (972) 489-4725. I will be happy to analyze your statement for you with NO obligations

whatsoever or anything of that sort. I promise to be completely transparent and OPEN (of course I would love the opportunity to earn your business).

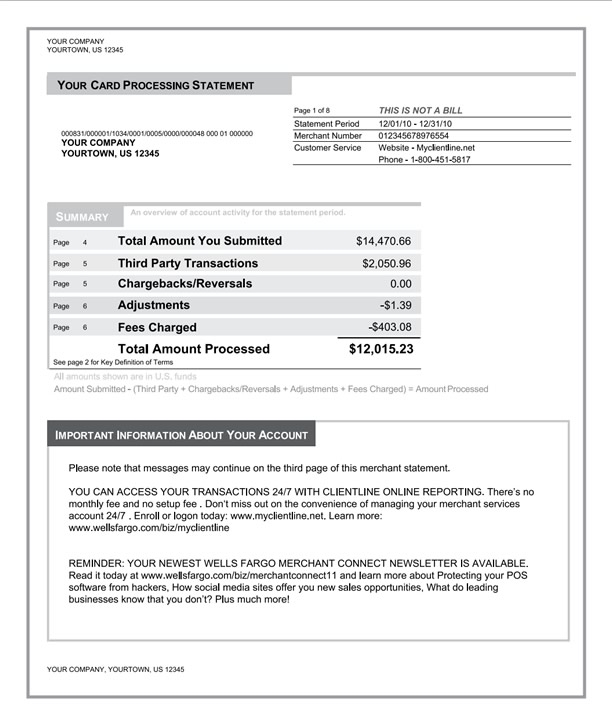

In most cases, it is simple. Pull out your latest merchant statement and identify two important figures from it:

1. The total cumulative dollar amount of credit card transactions processed for that month. Usually specified as total deposits or amount submitted. If there are any "third party" transactions, subtract this third party amount form total amount submitted. To use in our calculations below, we will call this resulting figure Total Processed. From the sample statement on the left this would be $14,470.66 - $2,050.96 = $12,419.70

2. The total fees and charges that were deducted from your statement. We will call this Total Fees (i.e. $403.08 from sample).

Now, once you have obtained these two figures, you can easily calculate your effective rate as follows:

From the sample on the left, it would be 3.245% (i.e. $403.08/$12419.70 x 100). Now that you have your effective rate you can determine with quite certainty whether you are being treated fairly.

If your effective rate is 3% or higher, that is generally a VERY bad rate. You need to change this situation as soon as possible Please CONTACT me. I would like the opportunity to change that for you. There could however be good reasons for this. Maybe your average ticket is $8? Or a majority of your transactions are International. International Transactions incur high fees from the Interchange, sometimes a whole 1% more than normal. Maybe you are "key"ing in your transactions instead of swiping them.

If your effective rate is around 2.5% that could be good or bad. So let me explain. If your average transaction amount is less than $10.00, then 2.5% could be an acceptable rate. But if your average transaction amount is more than $100 then it requires a little more in depth analysis of the customer demographic. Like what type of credit cards do most of your customers use? Debit Cards, Corporate cards or American Express? Here again, I would like to request you give me a chance to help analyze your statement in detail and advise you as best as I can.

Now if your effective rate is 2.00% or below then you are most probably in pretty good hands. That is a difficult number to get to. Feel free to send me an

There are two major rate structures that exist:

If you are on Tiered Rate this is almost always bad. Immediately look for another processor.

Some RED FLAGS to look out for:

If you identify any red flags or simply need a professional opinion on analyzing your merchant statements, you are welcome to call me at (972) 489-4725 or

Personally, I like to see business owners get a great deal on their merchant processing services. I too am a merchant and have had first hand experience at paying high processing rates until I became better informed. After being in this area of business for three years I realized that the best way to advise merchants is to create an informative website and provide a guide to easily figuring out if you are being treated fairly. I hope the information on this page has been informative and useful to you.

Please feel free contact me anytime at

Personally, I like to see business owners get a great deal on their merchant processing services. I too am a merchant and have had first hand experience at paying high processing rates until I became better informed. After being in this area of business for three years I realized that the best way to advise merchants is to create an informative website and provide a guide to easily figuring out if you are being treated fairly. I hope the information on this page has been informative and useful to you.

Please feel free contact me anytime at

Warm Regards,

Tariq Ausaf